Overview

This job aid provides step-by-step instructions for completing a PeopleSoft journal to claim credit card payments received.

This job aid provides step-by-step instructions for completing a PeopleSoft journal to claim credit card payments received.

Do not use this process to claim cash for gifts, sponsored projects, or for payment of a department accounts receivable invoice; see Handling Cash, Checks, & Incoming EFT for more information.

About Credit Card Journals (Source 323)

Journals to Claim Credit Card Payments are Time Sensitive

- All credit card payments should be claimed within 5 business days of deposit or receipt of funds.

- Credit card journals should be prepared, approved, and posted weekly.

- Payments deposited and received for the following month should not be processed until the system is open for the month (e.g., deposits made/payments received between November 1-5 can be recorded when the system is open for November entry).

- Review the General Ledger Monthly Schedule, including month-end close deadlines, on the Controller's Office website.

The following tables provide a quick reference for seasoned Journal Preparers and Journal Approvers who are already familiar with all journal entry steps and mechanics and would like to review the specific requirements for entering a credit card journal (Source Code 323). Complete instructions on how to enter a credit card journal follow in the sections below.

Credit Card Journal Header Tab Requirements

| Required Item | Guidelines |

|---|---|

| Journal Header Description | Clearly state the purpose of the deposit, including whether the payment is for reimbursement or refund. Always include the credit card transaction date. |

| Attachments | Proof of transaction is required for journal approval. Besides the information required by the Controller’s Office, you can also attach documents for your own records.

|

Credit Card Journal Lines Tab Debit and Credit Line Requirements

| Required Item | Debit | Credit |

|---|---|---|

| Account/Chartstring | Terminal Credit Card Transactions 10115 - Visa/MC/Disc or 11417 - AMEX Gateway Credit Cart Transactions 10100 - All credit card types | Enter Department's relevant chartstring. |

| Amount | Enter the settlement amount separated by credit card type for each report per day.

Note, refund amounts are netted into each settlement total line by credit card type. | Department determines allocation. |

| Reference | Enter the credit card type merchant account ID:

| Enter optional details relevant to the department. |

| Journal Line Description | Journal Line Descriptions should assist Journal Approvers and auditors in understanding what the funds are for. Format: MM/DD/YY CREDIT CARD TYPE Example: 01/01/22 VISA/MC/DISC or 01/01/22 AMEX

| |

Notes/Considerations: The Controller’s Office will review and reconcile posted cash and credit card journals on a weekly basis. Unreconciled journals will be flagged for additional review by Controller’s Office staff. Department journal preparers will be responsible for submitting any necessary journal corrections identified during the reconciliation process.

How to Log into PeopleSoft and Navigate to the Create/Update Journal Entries Page

- Log into MyAccess (not shown). Scroll down to locate and select PeopleSoft Financials from the application menu. If you have set MyAccess to display "Favorites", you may need to change to "All Apps" or search for PeopleSoft.

- Click on the General Ledger tile, then on the Create/Update Journal Entries tile a. The Create/Update Journal Entries page displays.

How to Begin a New Credit Card Journal

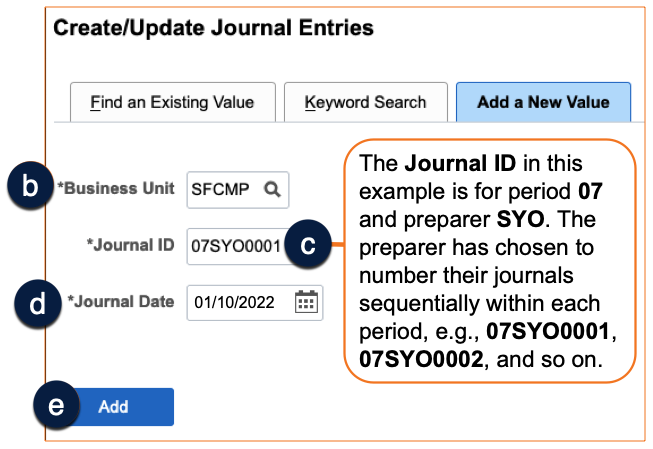

- Enter the correct Business Unit (defaults to the Business Unit set in your PeopleSoft System Profile) b.

Enter a Journal ID c, using the UCSF preferred "XXABCYYYY" format, where:

- XX = the fiscal period of the journal (e.g., 01, 02, 03)

- ABC = your specific 3-character Journal Preparer ID

- YYYY = a sequential numbering scheme of your choosing

Overwriting the default of NEXT allows you to locate your entered journals on the Find an Existing Value tab. Using this preferred method, you can easily change the Journal ID search to contain your Journal Preparer ID ("ABC") to quickly find any journal you have created.

- Enter the correct Journal Date (defaults to current) d.

- During the first two (2) business days of a month, you may enter dates in the previous month. Make sure to allow time for journal approval, ensuring the journal posts before month-end close.

- You may enter a date in a future period and save your journal, but you cannot edit or submit it until the period of the selected date opens.

- Click the Add button e.

How to Prepare the Header Tab for a Credit Card Journal

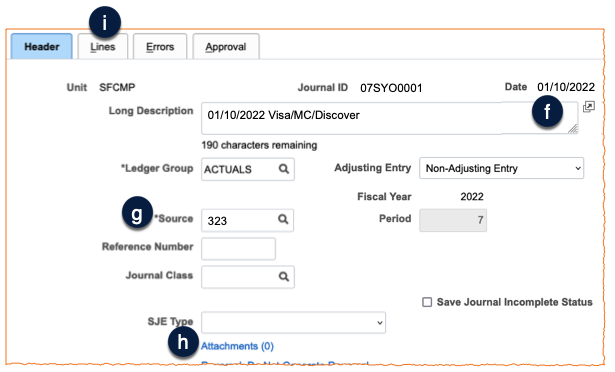

On the Header tab enter the following information:

- Long Description (required) - Clearly state the purpose of the deposit, including whether the payment is for reimbursement or refund. Always include the credit card transaction date f.

- Source – enter 323 g.

- Attachments – Proof of deposit is required for journal approval. Click to attach the required documentation to the journal h, then follow the attachment instructions in the next section of this guide.

- Lines - Click the Lines tab to enter the financial information for the journal i.

How to Attach Required Supporting Documentation on the Header Tab

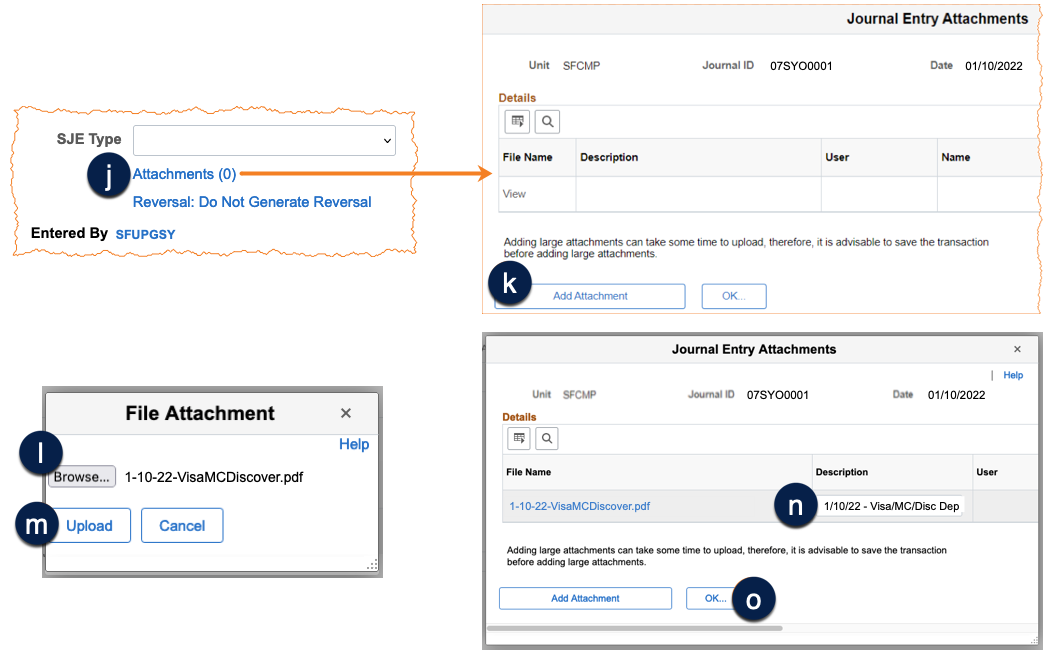

Proof of transaction is required for journal approval. Besides the information required by the Controller’s Office, you can also attach documents for your own records.

- Click the Attachments (x) link from the journal header tab (x = the number of attachments that have been uploaded to this journal) to attach all supporting documentation j.

- Click the Add Attachment button from the Journal Entry Attachments pop-up k.

- Click the Choose File or Browse button (depending on browser configuration) from the File Attachment pop-up l.

- (Not shown) Browse for the file you want to attach, select it, and click the Open button.

- Click the Upload button on the File Attachment pop-up m.

- Enter a Description of the uploaded document (optional) n.

- Repeat steps 2-6 for all other files to be attached, then click OK when done to return to the journal entry screen o.

Do not attach any document that contains sensitive personal data and/or credit card information!

| Acceptable Supporting Documents for Credit Card Journals Include at Least One of the Following |

|---|

|

How to Enter Financial Information on the Lines Tab

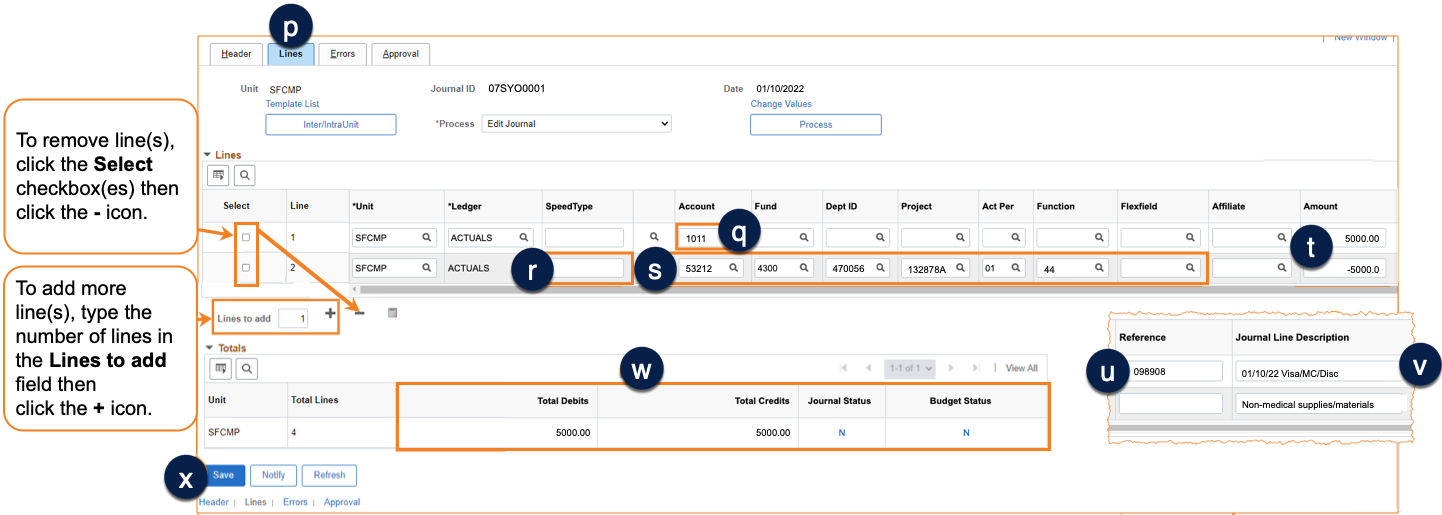

- Click on the Lines tab to enter the financial information on the journal p.

- For debit lines (positive Amount), enter only the Account, either 10115 - Visa/MC/Disc or 11417 - AMEX for terminal credit card transactions, OR 10100 - All credit card types for gateway credit card transactions q.

- For credit lines, enter the appropriate chartstrings: Business Unit / Account / Fund / Dept ID / Project / Act Period / Function / Flexfield

- Enter the SpeedType (if applicable) r, OR

- Enter your department's relevant chartstring information s.

- Enter the Amount for each line t.

- Enter the settlement amount as debit line(s) (positive dollar amount) separated by credit card type for each report per day:

- Combine Visa, Mastercard, and Discover totals into one debit line. This includes any debit card acceptance processed without a PIN number.

- Enter American Express settlement totals on a separate debit line.

- Do not combine multiple settlement tapes or reports into one line.

- Note that refund amounts are netted into each settlement total line by credit card type.

- You may enter multiple credit lines (negative dollar amounts) to allocate the transaction.

- Enter the settlement amount as debit line(s) (positive dollar amount) separated by credit card type for each report per day:

- Scroll over to the far right of the screen, where you will find the Reference field for each journal line u.

- Enter the credit card merchant account ID as follows for the debit line(s):

- Visa/Master/Discover - Last 6 digits of account ID, e.g., "098908"

- American Express - all 10 digits of account ID, e.g., "1234156970"

- In the Journal Line Description field v for the debit line:

- Enter MM/DD/YY CREDIT CARD TYPE, e.g., "01/01/22 VISA/MC/DISC" or "01/01/22 AMEX".

- Date represents the transaction date

- Following the date is the credit card type ‘Visa/MC/Disc’ or ‘Amex’

- Enter MM/DD/YY CREDIT CARD TYPE, e.g., "01/01/22 VISA/MC/DISC" or "01/01/22 AMEX".

- Enter the credit card merchant account ID as follows for the debit line(s):

- After entering all lines, Total Debits must equal Total Credits and the Journal Status should be N (not edited) w. If not, the mismatch must be corrected.

- Save the journal before moving on to the next step x.

How to Edit a Credit Card Journal

The Edit Journal process must be run prior to submitting any journal, and ensures that:

- All chartfield combinations are valid

- The journal date is in an open period

- Total Debits equal Total Credits

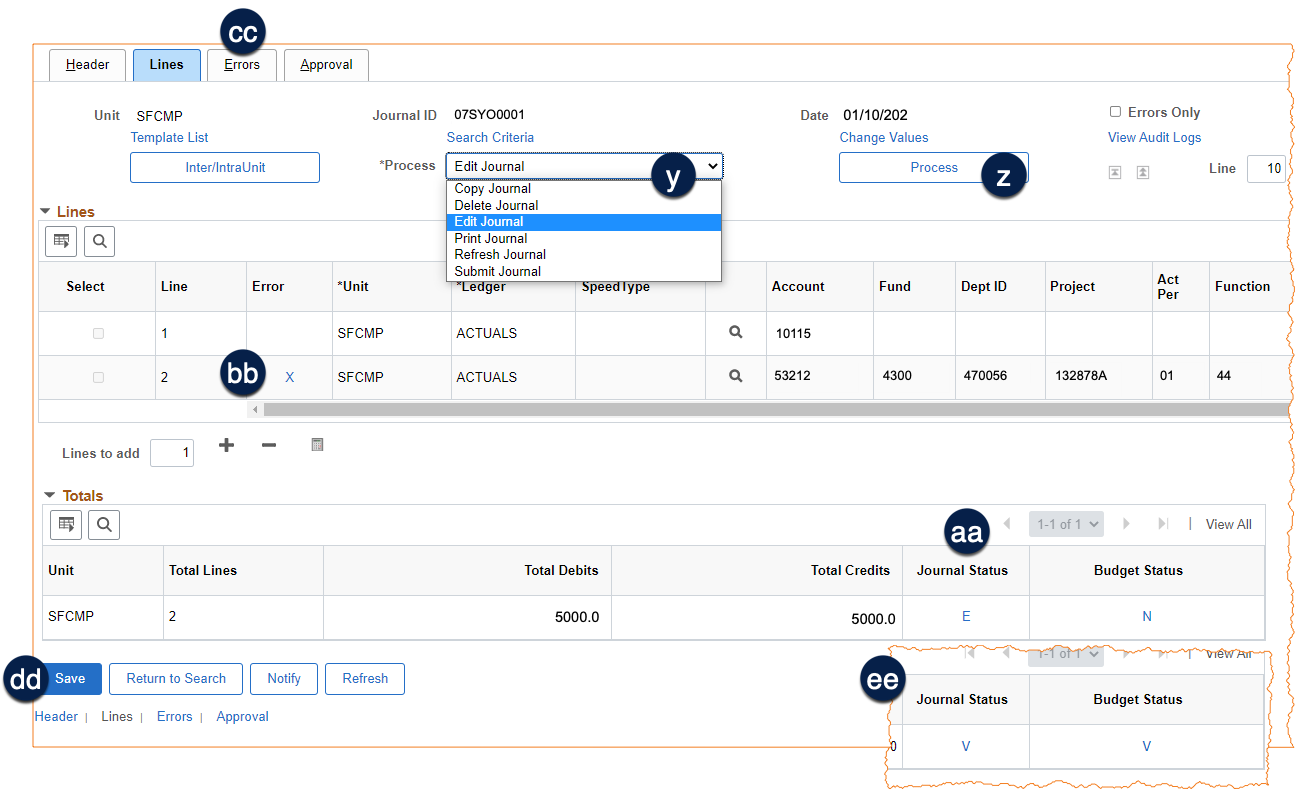

- Click the Process drop-down menu and select Edit Journal y.

- Click the Process button and wait until the edit process completes z.

- If there are errors, the Journal Status will display “E” (aa) and the lines in error will be marked with an “X” (bb).

- If you have an error status but no lines are marked in error, this is most likely because Total Debits do not equal Total Credits, or because the Journal Date is in a closed period.

- For lines marked with “X”, go to the Errors tab to review the error description cc. Refer to the Combo Edit Rules Reference Guide for more information regarding valid chartfield combinations.

- When the errors are corrected, click the Save button dd.

- Re-run the Edit Journal process by repeating steps 1-2.

- When the Edit Process is successful and there are no errors, Journal Status is set to V (Valid), and the journal can now be submitted for approval ee.

How to Submit a Credit Card Journal for Approval and Monitor Approval Status

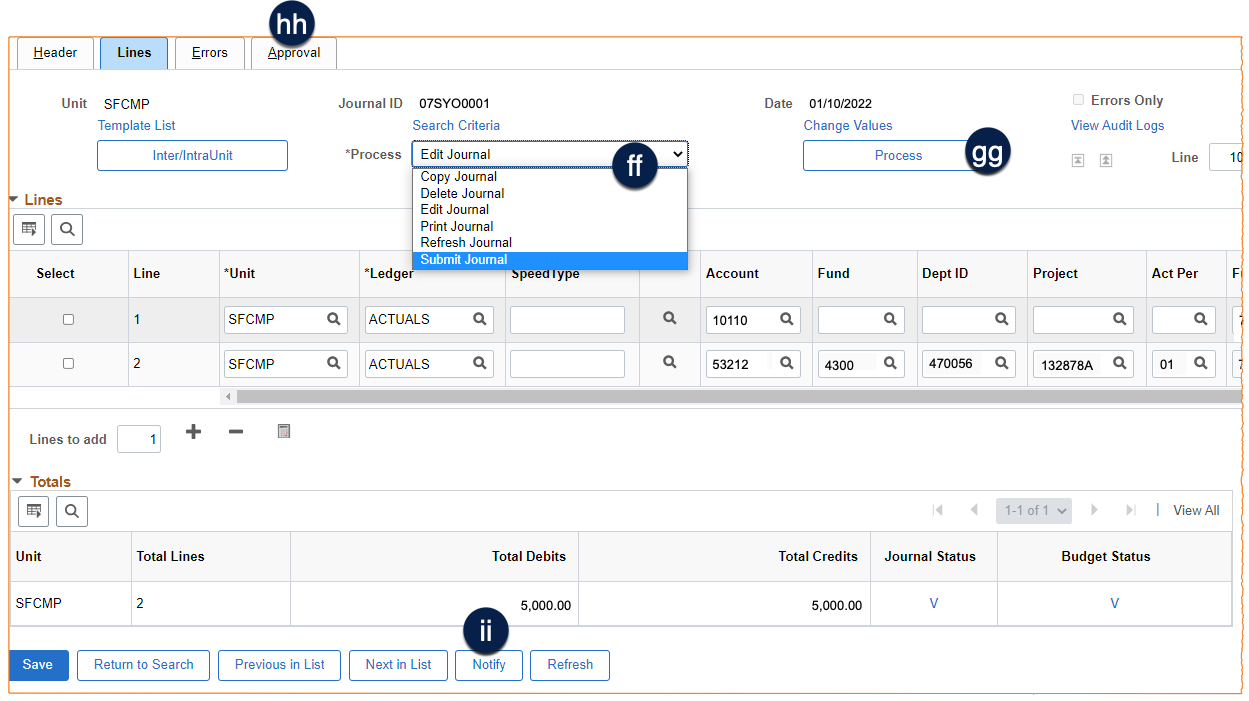

- Change the Process drop-down menu to Submit Journal ff.

- Click the Process button gg.

- Click on the Approval tab to view the Approval Status and list of approvers hh. The journal will be in the first approver’s Worklist until action is taken.

- Click the Notify button at the bottom of the page if you wish to notify the Approver via email ii.

- Return to the Approval tab at any time in the journal cycle to see the current step of the approval process hh.