Overview

Department Accounts Receivable (Dept A/R, also known as ‘sundry debtor’ receivables) is the amount due to the University from an external customer for payment of a good supplied and/or service already rendered.

Dept A/R excludes sponsored projects, student/employee and UCSF Health related receivables. Dept A/R is not applicable to business conducted with other campuses or with the Office of the President (UCOP); see Handling ITF and IOC for procedures related to Interlocation Transfer of Funds (ITFs) and Intercampus Orders & Charges (IOCs).

Key Concepts

University departments may allow external customers (customers not affiliated with the University of California) to use UCSF property or receive goods or services. By policy), University departments should collect payment before or upon delivery of the good or service. However, in the following circumstances it may be necessary to provide a good or service prior to receiving payment:

- There is no appropriate facility for collecting payment or when non-collection of payment is deemed to be in the best interest of the University. In these cases, prudence with respect to the credit risk incurred must be observed at the time of transaction.

- Credit is automatically extended to governmental units, foundations, and medical financial sponsors during the time claims for reimbursement are outstanding. Diligence must be exercised to ensure timely billing and collection efforts to minimize the receivables arising from these claims.

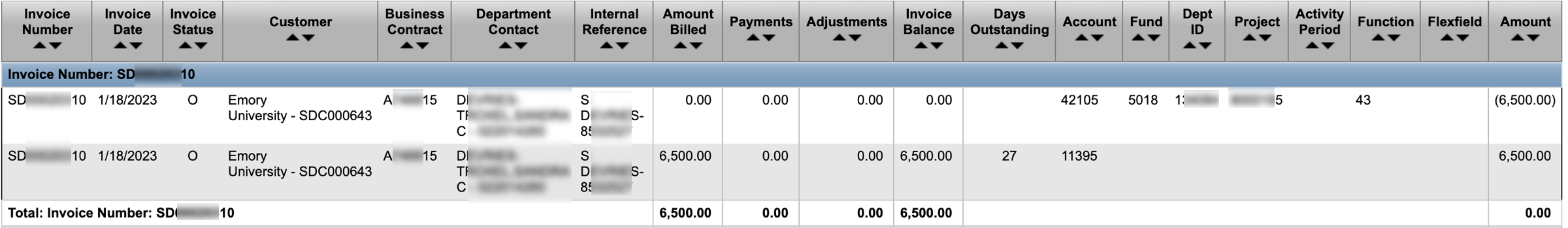

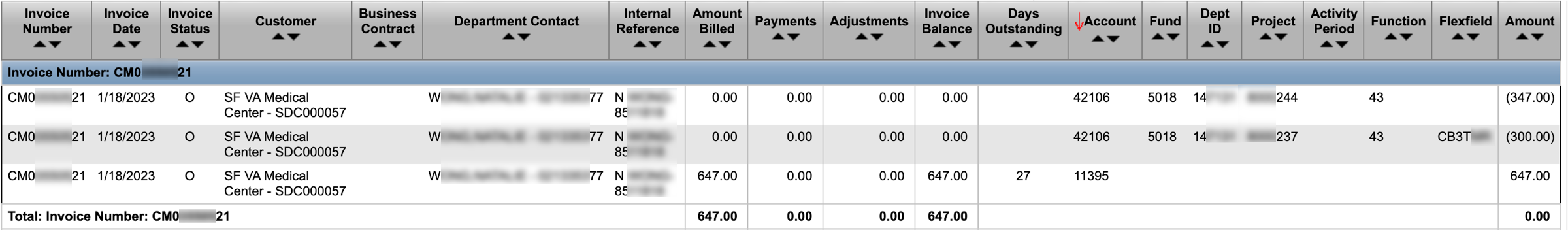

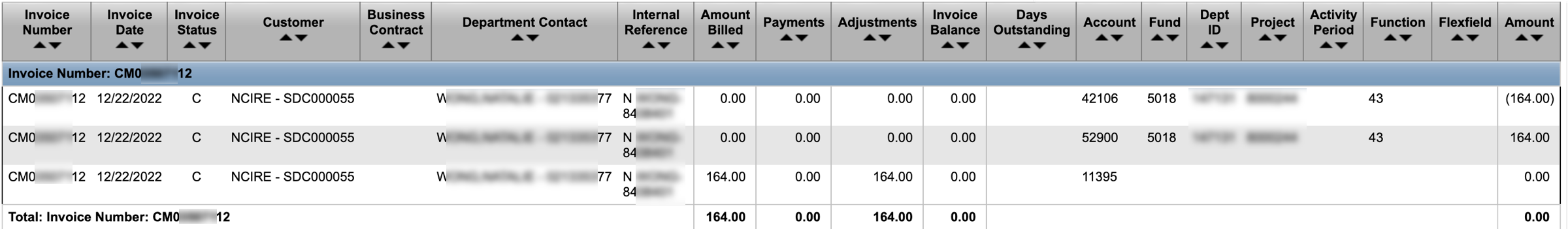

The University provides an invoice to the customer outlining the goods and services rendered that serves as an official demand for payment. The receivable and associated revenue must be reflected accurately and timely in the University’s financial records. Upon the delivery of a good or service, the revenue is considered to have been earned. Invoices must be recorded on an accrual basis to record accounts receivable (debit) and revenue (credit) at the time of billing. In a MyReports Department Accounts Receivable Report, note that although there will be a credit to revenue, you can determine that the invoice has not yet been paid because the amount in the Payments column will be $0.00.

Departments may choose to split an invoice between two or more chartstrings; chartstrings are included in the invoice prepared by the department and submitted to the Controller's Office.

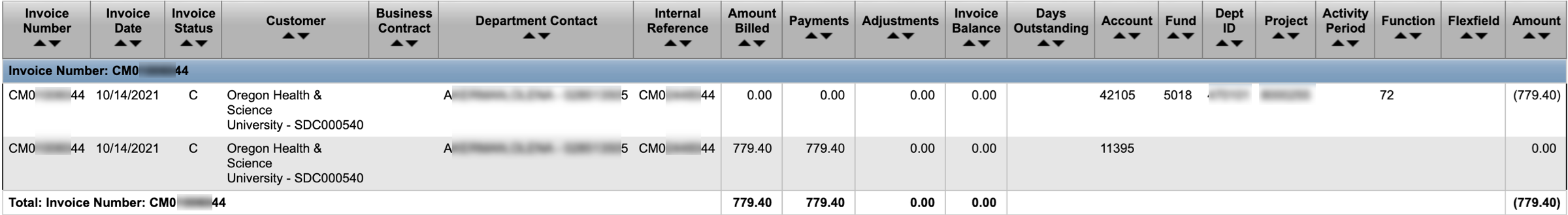

When payment for an invoice is received, transactions are recorded in the University’s financial system to credit accounts receivable and debit cash. In the MyReports Department Accounts Receivable report, there will be an entry for Account 11395, A/R-sundry debtor holding account (asset) in both the Amount Billed and Payments columns. Note that you cannot view entries to cash accounts in this report.

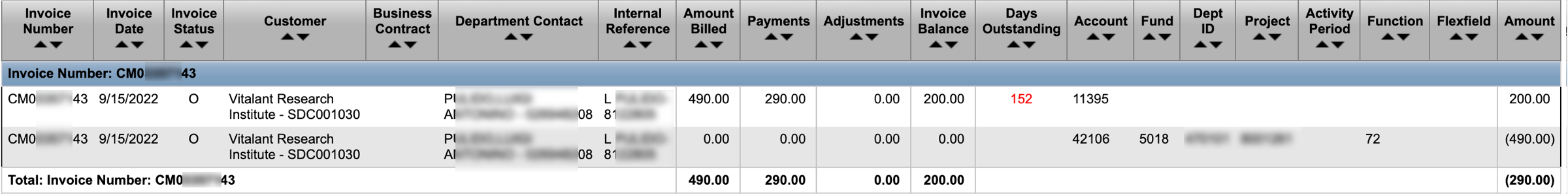

An open invoice with partial payment will display entries in Payments and a remaining Invoice Balance. Note that you cannot view entries to cash accounts in this report.

Invoices processed by the Controller’s Office that remain uncollected six months past the invoice billing date will be written-off and charged to the respective department (credit to accounts receivable and debit to expense). In the MyReports Department Accounts Receivable Report, you will see the write-off entry in the Adjustments column and a zero Invoice Balance. If payment is received after the chargeback, Department AR will reinvoice for payment application. The new invoice will reverse the Bad Debt Expense Account entry from Account 52900 and will contain the original invoice number in the Internal Reference column for easier reconciliation.

Steps for UCSF Departments

- Establish relationship with outside customer, normally using a business contract, affiliation agreement, or industry contract

- Establish the external customer and link your department with the customer in the University financial system. Follow the instructions in Submitting Department Accounts Receivable Invoices.

- Provide goods or service. If accepting payment at time of service, follow Handling Cash and Checks, Accepting Electronic Funds Transfers (EFTs), and Handling Credit Cards.

- If the good or service is provided prior to payment, create and submit a request for an invoice to the Controller’s Office.

- Follow the instructions in Submitting Department Accounts Receivable Invoices.

- The Controller’s Office will record transactions in the University’s financial system, enter the billing date, assign an invoice number, and email the invoice and supporting documentation to the external customer. The Controller's Office will submit the invoice in the external customer's portal rather than sending email, where required.

- Monitor invoices and payments, identify and claim appropriate cash deposits, and follow-up with customers on outstanding payments to avoid write-off of unpaid invoices. Follow the instructions in Monitoring Department Accounts Receivable.

- If you receive a check as payment for a Dept A/R invoice, send the check immediately to the Dept A/R lockbox. See Handling Cash and Checks for lockbox addresses and instructions.

If you have questions or need assistance with the Dept A/R process, send an email to [email protected].

Departments who choose to maintain their own accounts receivable and that do not submit their invoices to the Controller's Office (for recording in the University's financial system and distribution of the invoice to the external customer) must demonstrate the ability to comply with UCSF Policy 300-11, Accounts Receivable and with generally accepted accounting principles (GAAP). Dept A/R not recorded by the Controller's Office must be recorded by the department via journal entry.