Overview

Collection efforts for department accounts receivable (Dept A/R) invoices are the responsibility of the department providing the property, good, or service.

If an external customer does not pay an invoice within 30 days, it is considered delinquent. Departments should contact the external customer to follow-up on delinquent invoices.

Departments can use the Department Accounts Receivable Report available in MyReports to identify the status of their invoices. The Controller’s Office provides a Unclaimed Payments List to help departments identify payments that may apply to their invoices. Departments work with the Controller’s Office to ensure accurate and timely recording of associated transactions in the University’s financial system.

Monitoring Department Accounts Receivable Invoices

At least monthly, departments should review and analyze the Department Accounts Receivable Report available on the Operational Reports tab in MyReports. Departments should research any unusual items. Outstanding invoices should be compared to the Unclaimed Payments List for potential payments.

If an invoice remains unpaid after 30 days, the department should follow-up with the customer, and continue to follow-up on aging invoices until payment is received or the invoice is written-off as bad debt. The MyReports Department Accounts Receivable Report will display the number of days outstanding (difference between the date the report is run and the invoice date) for open invoices including those with partial payment.

If a customer responds that they paid the invoice, the department should obtain the following information to assist in identifying the missing payment:

- Wire receipt, or

- Copy of front and back of cleared check

Using this information, follow the steps outlined in Identifying and Handling Unclaimed Payments to locate the payment in the Unclaimed Payments List and notify [email protected] to claim the payment, if found.

Identifying Unclaimed Payments

Departments should follow the procedures outlined in Identifying and Handling Unclaimed Payments weekly to identify payments applicable to their Dept A/R invoices. Departments do not prepare a PeopleSoft cash journal to claim Dept A/R payments. Instead, departments should email [email protected] with details on any payments applicable to your invoices. Remember to include the following information from the Unclaimed Payments List:

- Bank Posting Date or As of Date

- BAI Code Description

- Customer Reference, if any

- Bank Reference

- Payer/External Customer Name, if available

- Bank Deposit Amount

Write-Off of Unpaid Invoices

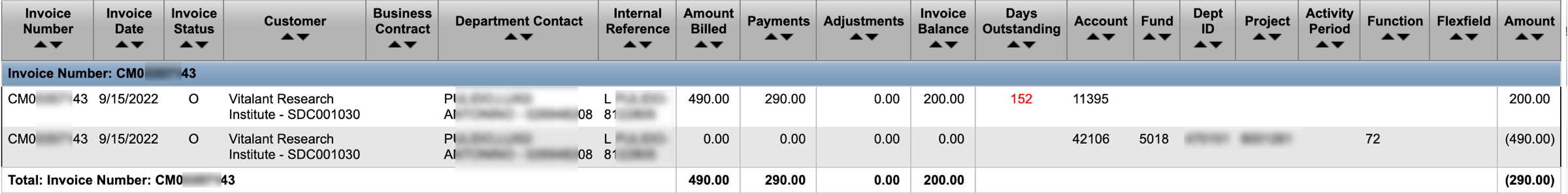

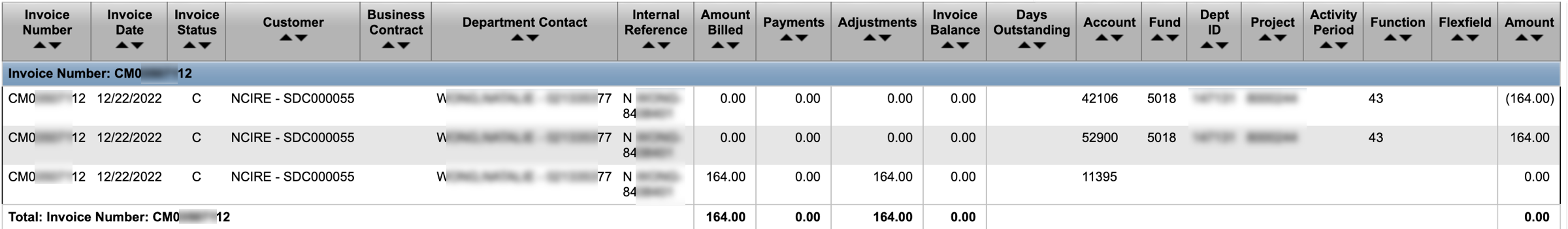

Dept A/R invoices processed by the Controller’s Office that remain uncollected for six months past the invoice billing date will be written-off and charged to the respective department as bad debt expense (Account 52900 – Bad Debt Expense-Uncollectable). Controller's Office staff will record a credit to A/R (Account 11395) and a debit to expense. In the MyReports Department Accounts Receivable Report, you will see the write-off entry in the Adjustments column and a zero Invoice Balance.

Departments that choose to maintain their own accounts receivable and that do not submit their invoices to the Controller's Office are responsible for writing-off their uncollectable invoices. For department invoiced uncollectible invoices/accounts, authority to write off bad debt has been delegated to the respective departments. Supporting documentation must be maintained by the department to justify write-off of uncollectible invoices.