This guide outlines how to understand PPS Payroll Transactions on the Transaction Detail Report (TDR) and the Distribution of Payroll Expense (DPE) by Account and Alt Account Reports.

Common Differences between the General Ledger (GL) and the Distribution of Payroll Expense by Account (DPE)

Two payroll processes commonly result in differences between the General Ledger (as viewed in the MyReports Transaction Detail Report or TDR) and the Distribution of Payroll Expense (DPE) Report:

| Payroll Process | Displayed in GL (TDR) | Displayed in DPE | Resolution | Example(s) |

|---|---|---|---|---|

Fails PeopleSoft combo edit when the payroll journal is edited at month-end. |

No |

Yes |

|

The typical timeline to clear a payroll expense charged to an invalid chartstring takes ~2 months:

|

Cannot be processed through payroll system or payroll system is unable to identify a fund source to charge for the expense. Posts directly to the ledger. |

Yes |

No |

|

|

Tips on Identifying Payroll Transactions in the MyReports Transaction Detail Report (TDR)

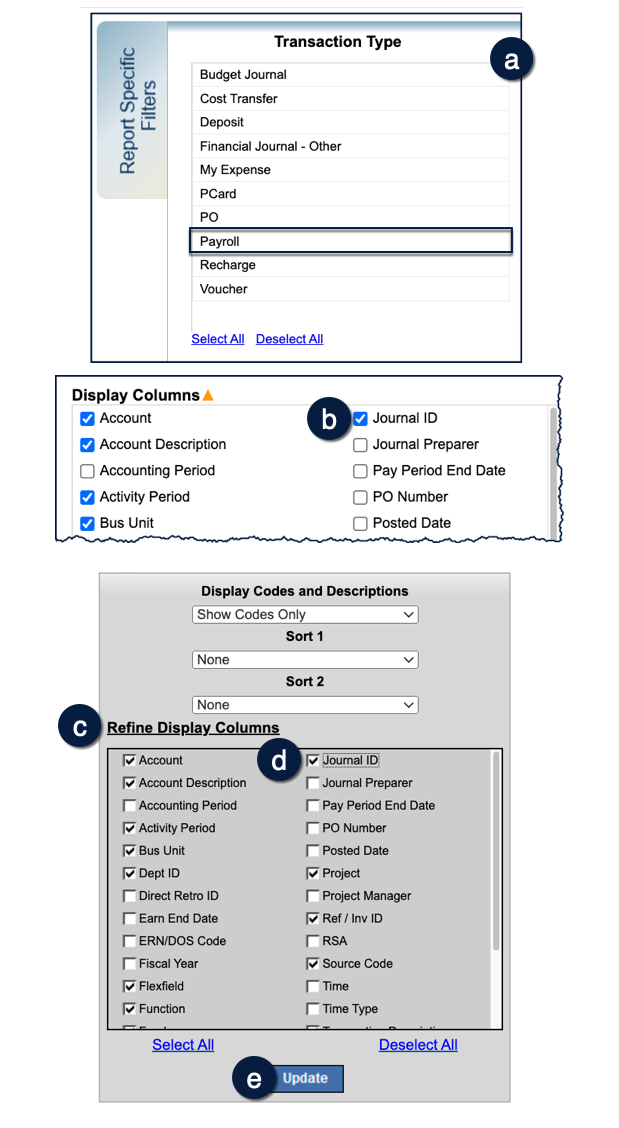

- You can limit your report to display only Payroll transactions by using the Transaction Type section of the Report Specific Filters .

- To select only Payroll transactions, click the Payroll line; the other items (all selected by default) are automatically deselected.

- To select only Payroll transactions, click the Payroll line; the other items (all selected by default) are automatically deselected.

- In addition to suppressing the other transaction types, you can select Journal ID in the Display Columns section of the report specific filters to display the Journal ID column .

- To display the Journal ID from the report view:

- Click Refine Display Columns in the upper right-hand corner .

- Select the checkbox for Journal ID .

- Click the Update button .

Understanding How PPS Payroll Transactions are Displayed in the TDR Report

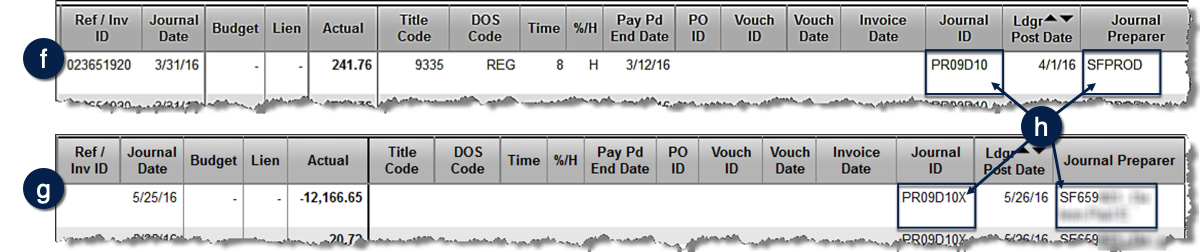

Expenses processed through the DPE display with Journal ID PR##D10, where ## is the corresponding accounting period. Entries to correct suspended payroll have Journal ID PR##D10X, which is the Journal ID of the original payroll journal with a letter(s) added to the end. The examples show how these transactions are displayed in the Transaction Detail Report.

- Original payroll journal (from March General Ledger) .

- Suspense correction for March payroll (May General Ledger) .

Note the differences in Journal ID and Journal Preparer between the original pay and manually entered correction .

Additional Information and Assistance

- If you have questions regarding payroll differences between the GL and DPE, please contact [email protected] with a detailed description.