Overview

This guide covers UCSF processes for recording expense accruals when required during sponsored award financial reporting and closeout.

During Final Financial Reporting, Invoicing and Closeout of Sponsored Awards, departments ensure that all expenses are complete, accurate and allowable, and that costs from subawardees, other Dept IDs, and recharge units have been recorded in the General Ledger (GL). In situations when expenses have not been recorded in the GL, an expense accrual may be required. An expense accrual is the recording of the cost estimate for a product or service that was delivered during the award period but has not yet been recorded in the GL. Creating an accrual ensures that all direct expenses are properly recorded at Final Invoicing, Reporting and Closeout.

If anticipated non-payroll expenses are not recorded in the GL, the award Research Services Analyst (RSA) creates an accrual journal in PeopleSoft and checks the appropriate box on the Final Reporting Certification in the Research Administration System (RAS). If a payroll expense or correction is not correctly recorded in the GL, the RSA or other department delegate submits a salary or benefit cost transfer, creates an accrual journal in PeopleSoft, and checks the appropriate box on the Final Reporting Certification (FRC).

The Use of Accruals in Financial Reporting and Invoicing

For all accrual entries, the RSA should request approval by the Department Approver and Contracts and Grants Accounting (CGA) Analyst. If approved, the accrual will be posted to accurately report expenses to the sponsor.

Examples of expenses to accrue:

- Subaward invoices for services delivered within the award period but for which the invoice will not be received prior to the processing end date.

- Recharges for services delivered within the award period but for which the charge will not be recorded prior to the processing end date.

- Travel which occurred within the award period but for which the charge will not be recorded prior to the processing end date.

- Vendor services which were provided within the award period but for which the invoice will not be received prior to the processing end date.

- Allowable post-award publication costs (see Uniform Guidance Key Concepts – Publication Costs).

- Salary and benefit cost transfers.

- Biweekly payroll accrual reversals that will not be recorded prior to the award processing end date.

Award accruals are NOT used for:

- Estimated unallowable expenses (e.g., goods/services occurring after the award expiration date)

- Cost transfers

Follow the steps below to ensure accruals are valid based on current and outstanding financial information, including subawards, purchase orders, salary or benefit cost transfers, before submitting them for approval. As actual costs are posted to the GL, ensure the proper process indicated below is followed for reversing any accrual entries.

Subawards

Review the status of all subawards and any outstanding invoices to be paid.

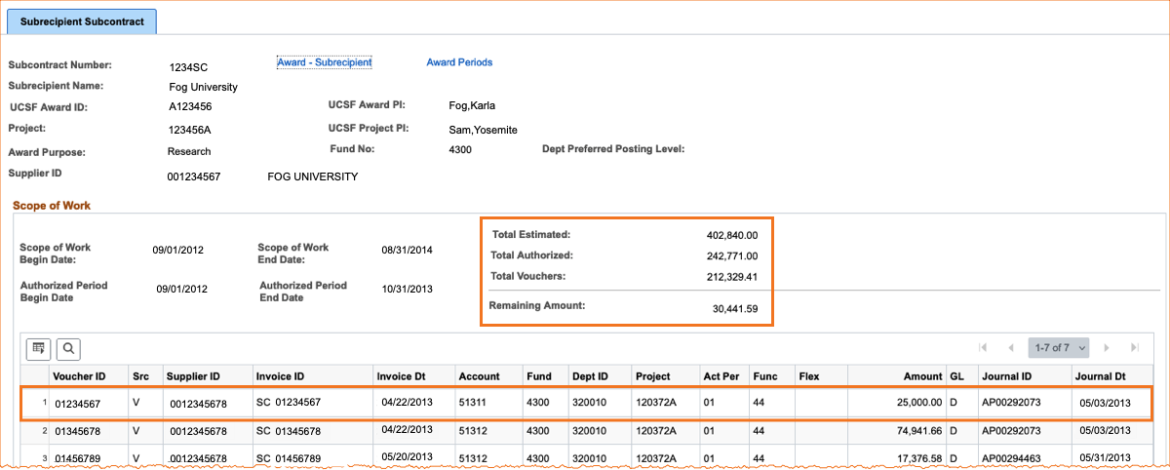

- Confirm the status of the subaward portion of the research and estimated final invoice amount. Subaward accruals should generally equal the estimated final invoice amount, and should never exceed the Remaining Amount in RAS.

- Verify subaward payments received, payments outstanding, and remaining balance in RAS/PeopleSoft.

- (Not shown) Log on to PeopleSoft and search for, or navigate to, the Award Profile. Enter the Award Number or other search criteria and click the Search button.

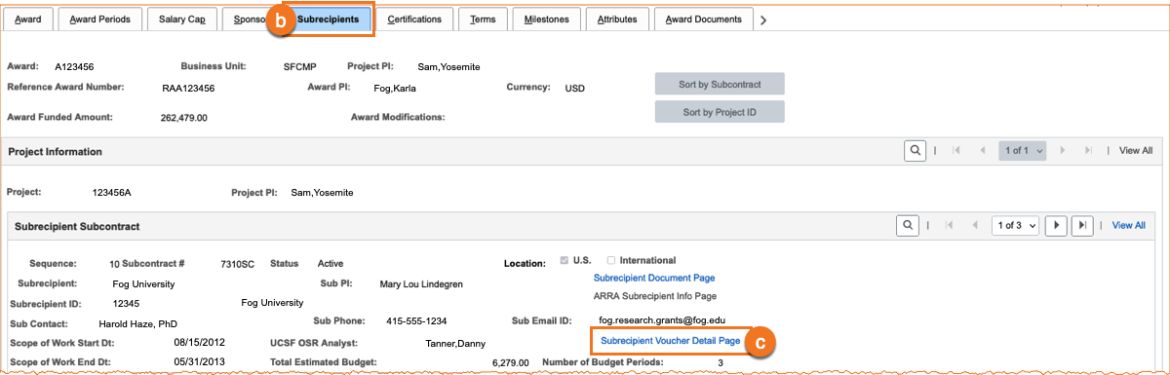

- Select the Subrecipients tab.

Select the Subrecipient Voucher Detail Page link.

Review the Total Authorized, Total Vouchers, and Remaining Amount. Confirm the information is correct and invoices to be received and/or approved.

Purchase Orders

Verify the status of open Purchase Orders (POs) and the allowable/allocable amount to be encumbered or posted using BearBuy.

- Run the MyReports “Purchase Order Lien Balance Report.” See the job aid PO Lien Balance Report for details on running a report.

- Review POs in BearBuy

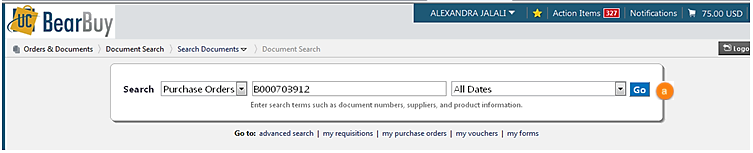

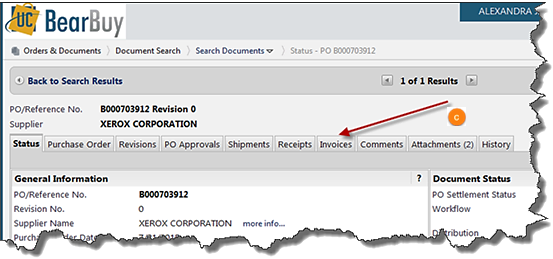

Navigate to BearBuy. From the document search page, enter the PO number and click Go.

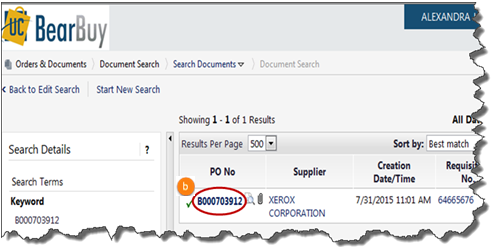

Click on the PO No hyperlink

Click on the Invoices tab to view invoice details.

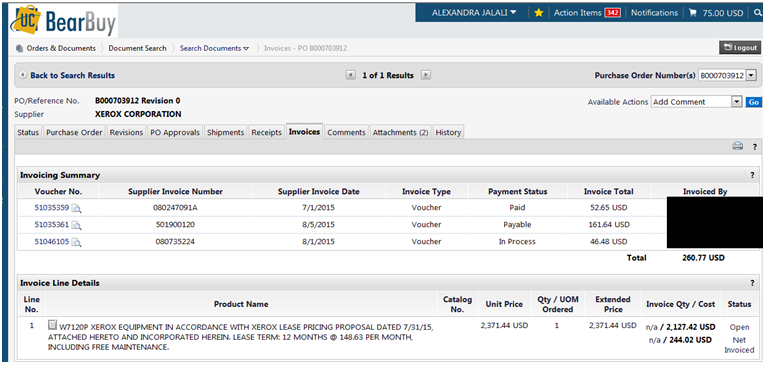

- The invoice statuses will be displayed. Validate and determine the outstanding purchases to be processed.

Ensure the requested accrual amount falls within the budget period and pertains to the award.

Salary Cost Transfers and Benefit Cost Transfers

Review the status of all payroll, both posted and pending, to determine if adjustments are needed based on allowable effort expended within the period.

Run the MyReports Distribution of Payroll Expense (DPE) Report by payroll period to validate posted and pending payroll. This report is available by Account and by Alt Account. See the job aids Distribution of Payroll Expense (DPE) by Account Report or DPE by Alt Account Report for details on running the report.

- Examples of pending payroll include vacation accruals, payroll in suspense and payroll posted to the departmental default account.

- Examples of posted payroll that should be adjusted include effort expended outside of the award reporting period.

If adjustments are required, department Salary Cost Transfer Initiators are responsible for completing a salary cost transfer (Direct Retro) in UCPath. Departments use the Benefit Cost Transfer Worksheet to request transfers of benefits expenses without also moving salary expenses.

Central Payroll is responsible for clearing the payroll suspense account so that all payroll transactions are correctly posted to the General Ledger. Following the posting of suspended payroll to the suspense account, the Payroll Office will reach out to identify a posting level Dept ID to use to move payroll suspended on a non-posting Dept ID and Project “2222222”. The expense will be moved by the Payroll Office via financial journal. Departments must then perform a salary cost transfer (Direct Retro) in UCPath to move the expense to a valid chartstring.

Biweekly Payroll Accrual and Reversal Transactions

In most cases, both the biweekly payroll accrual and reversal transaction will post to the General Ledger prior to the award processing end date; no action should be taken to move the biweekly payroll accrual or reversal. If the award has employees who are paid biweekly, review all biweekly payroll accruals and reversals to determine whether both the accruals and reversals will post prior to the award’s processing end date.

Run the MyReports Transaction Detail Report for Accounts 50432 (Salary accrual) and 50518 (Benefit accrual – staff) for the entire reporting period and Project. If all biweekly accruals and reversals have posted, the report total will be zero.

If the report total is not zero, determine what accruals and/or reversals have not posted.

- If a reversal has posted and the associated accrual has not posted, the accrual is in suspense. Work with Payroll to resolve biweekly payroll accruals in suspense.

- If an accrual is posted but the reversal has not posted, has the next month’s payroll journal been posted yet?

- If not and the next month’s payroll journal will post prior to the award’s processing end date, no action is necessary.

- If not and the next month’s payroll journal will post after the award’s processing end date, include the reversal in an accrual (source code 549) journal and on the Final Reporting Certification Form.

Note that you cannot use a salary cost transfer or benefit cost transfer to accrue a biweekly payroll accrual reversal, and that you should not accrue the biweekly payroll accrual, only the reversal.

Instructions for Preparing and Reversing an Accrual Entry

Payroll and non-payroll accrual entries can be entered into PeopleSoft for those costs that are not recorded in the GL in time for final financial reporting and invoicing of a sponsored award. Departments may enter the accrual journal using Source Code 549 for these pending direct expense and salary costs.

Preparing Non-Payroll Accrual Journals

Follow the regular process for preparing a PeopleSoft journal using the following details:

- Journal Source code: 549

- Chartstring:

- Debit:

- Fund, Dept ID, Project, Activity Period, Function, Flexfield of the sponsored award

- Account codes: Actual account of the anticipated expense

- Credit: Account 23183 - OCL-spon rsch nonpay accrual

- Debit:

Example Non-Payroll Accrual:

Anticipated Consultant Expense for $5,000.00

| Account | Fund | Dept ID | Project | Activity Period | Function | Flexfield | Amount |

|---|---|---|---|---|---|---|---|

| 55101 | 4xxx | xxxxxx | xxxxxxA | xx | xx | Opt. | 5,000.00 |

| 23183 | 4xxx | xxxxxx | xxxxxxA | xx | xx | Opt. | (5,000.00) |

Preparing Payroll Accrual Journals

Payroll accrual journals should only be used for salary cost transfer adjustments submitted using a UCPath Direct Retro that have not yet posted to the GL. This may also be used for Late Cost Transfers that have been submitted via UCPath but are under review by CGA Compliance. Upon the actual salary cost transfer (direct retro) payroll posting, the accrual journal should be reversed. If the late cost transfer does not get approved, a reversal of the accrual should be processed.

Follow the regular process for preparing a PeopleSoft journal using the following details:

- Journal Source code: 549

- Chartstring:

Debit:

- Fund, Dept ID, Project, Activity Period, Function, Flexfield of the sponsored award

- Account codes: use the Account Codes below to record the accrual to the applicable category. A lump sum by Account Code may be used.

Account Code Description 50109 Other FAC salaries PET accrual 50309 NFA salaries PET accrual 50439 Staff PET salary accrual 50579 Staff benefit PET accrual 50629 Faculty PET benefit accrual 50759 NFA PET benefit accrual - Credit: Account 23183 - OCL-spon rsch nonpay accrual