Overview

This article describes procedures to deposit checks, money orders, traveler's checks, and certified checks that are NOT received as gifts or for sponsored research or as payment for a department accounts receivable or auxiliary and administrative services invoice.

Key Concepts

The University uses separate bank accounts to segment cash operations by business function. Each account has a unique, corresponding lockbox for sending paper checks, which is the preferred method for handling all check payments.

In some instances, departments may need to make deposits using a drop safe location, armored car pickup, or at a bank location. The procedures below apply to checks, money orders, traveler's checks, and certified checks that are NOT received as gifts or for sponsored research or as payment for a department accounts receivable or auxiliary and administrative services invoice. Refer to the following for further guidance:

Processes

Handling Domestic Checks

Deposits must be made once a week or whenever cash and check total is $500 or more, whichever comes first. Customer and patient information must remain confidential.

- Photocopy all checks for the department's record

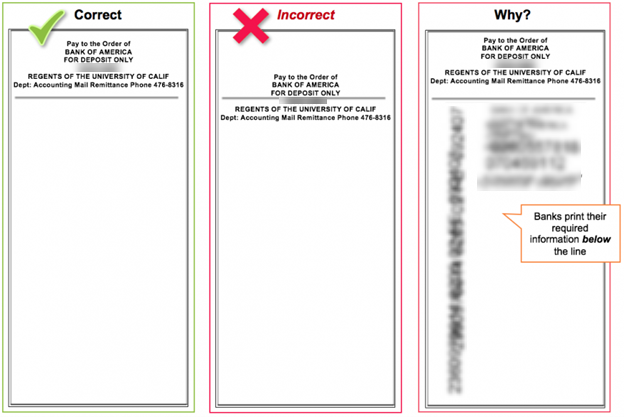

- Endorse checks:

- "For deposit only" immediately upon receipt

- In the proper location on the check to avoid obscuring of important information

Use a legible stamp with the correct phone number to avoid delays in department notification of a returned check

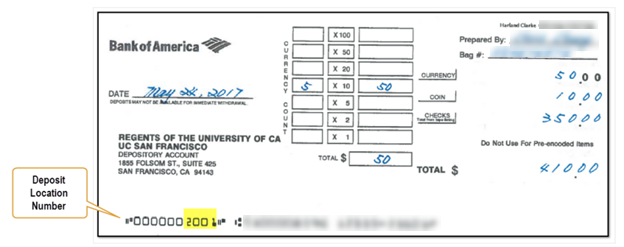

- Complete a UCSF pre-printed deposit slip. UCSF pre-printed deposit slips include UCSF bank account details and a unique four-digit code in the bottom left corner, referred to as the deposit location number. Each department is assigned a unique deposit location number to track and identify deposits when they reach our bank.

- Ensure total deposit amount is accurate

Write depositor name and bag number on the deposit slip

- Write the deposit location number on bank deposit bag

- Place checks with deposit slip inside numbered secure bank deposit bag

- Deposit the bag directly at Bank of America, by armored car pickup, or into one of the following drop safe locations:

- Laurel Heights – Main lobby: near the guard station

- Mission Bay – Genentech Hall: near the guard station

- Mission Center Building – Main lobby: near the guard station

- Mt. Zion Hospital – First Floor: near the Security Office

- Parnassus Campus – Millberry Union East, Room 232A (contact [email protected] for access request instructions

- Zuckerberg San Francisco General Hospital – Building 5, Room 1N1 (Deposits can be made Monday, Wednesday, Thursday, and Friday, from 9 to 9:30 a.m. Prior to making a deposit, call Emelyn Zavaleta

For all deposits, departments must prepare a corresponding cash journal (source code 320) in PeopleSoft Financials.

Handling Checks for Other Payments: Foreign Checks

This procedure applies to foreign checks that are NOT received as gifts or for sponsored research or as payment for a department accounts receivable or auxiliary and administrative services invoice.

Foreign check deposits cannot be processed using a drop safe or remote scanner. Eligible items must be processed by the Bank of America Exceptions Unit or at a local Bank of America branch.

Eligible items are checks that are:

- In United States dollars (USD) drawn on a Canadian Bank

- In USD drawn on a United Kingdom bank

- In any foreign denomination drawn on a foreign bank

Before preparing your deposit, ensure that:

- You do not commingle currencies. For deposits of multiple currencies, a separate deposit slip is required for each currency.

- The legal amount (amount in words) and the courtesy amount (numeric amount) match. If the amounts differ, the legal amount takes precedence over the courtesy amount; handwrite the correct dollar amount based on the legal amount above the courtesy box.

- The dollar amount is legible. Pay particular attention to items with dark backgrounds and small, light print. If it is not legible, handwrite the amount above the courtesy amount.

Step One: Prepare the Deposit

- Endorse check(s) immediately upon receipt.

- Complete your department’s UCSF pre-printed deposit slip and maintain a copy for the cash journal.

- To calculate the deposit value, use an online currency converter to retrieve the exchange rate as of the day you prepare the deposit.

- Enter the USD equivalent for the check.

Step Two: Determine your Deposit Method

The preferred method is to FedEx all deposits to the Bank of America Exceptions Unit for processing.

Prepare a FedEx label to the Recipient address below:

Bank of America

Attn: Atlanta Bank by Mail

Southside Center

6000 Feldwood Road

Mail code: GA4-004-01-52

College Park, GA 30349-3652- FedEx the following to the bank:

- Department’s UCSF pre-printed deposit slip (must be completed)

- Foreign check (must be endorsed)

For multiple deposits, each deposit slip and corresponding check(s) must be grouped separately using a paperclip (do not staple).

As an alternative, make the deposit at a local Bank of America branch.

Step Three: Prepare a Cash Journal

- Prepare a corresponding cash journal (source code 320) in PeopleSoft using the USD equivalent written on the deposit slip.

- Email the journal entry number to [email protected] with the subject “Foreign check deposit”.

When your department’s deposit is received by the bank, the bank will post a deposit to our bank account for the same USD value written on your deposit slip. This is the same amount used in your PeopleSoft cash journal. The bank will also post a separate value in our bank account for any differences in the exchange rate that occurred while the deposit was in transit. The Controller’s Office will notify you of this adjustment value and prepare the corresponding cash journal adjustment entry in PeopleSoft using details from your original cash journal.